If you get statements every month for credit cards or credit accounts, you’ve probably noticed they’re packed with information. It can be tempting to glance at the due dates and payment amounts and stop right there.

We think it’s worth taking a little time to understand all the parts of your statement, so we’ll break down an example statement for you and explain all the parts.

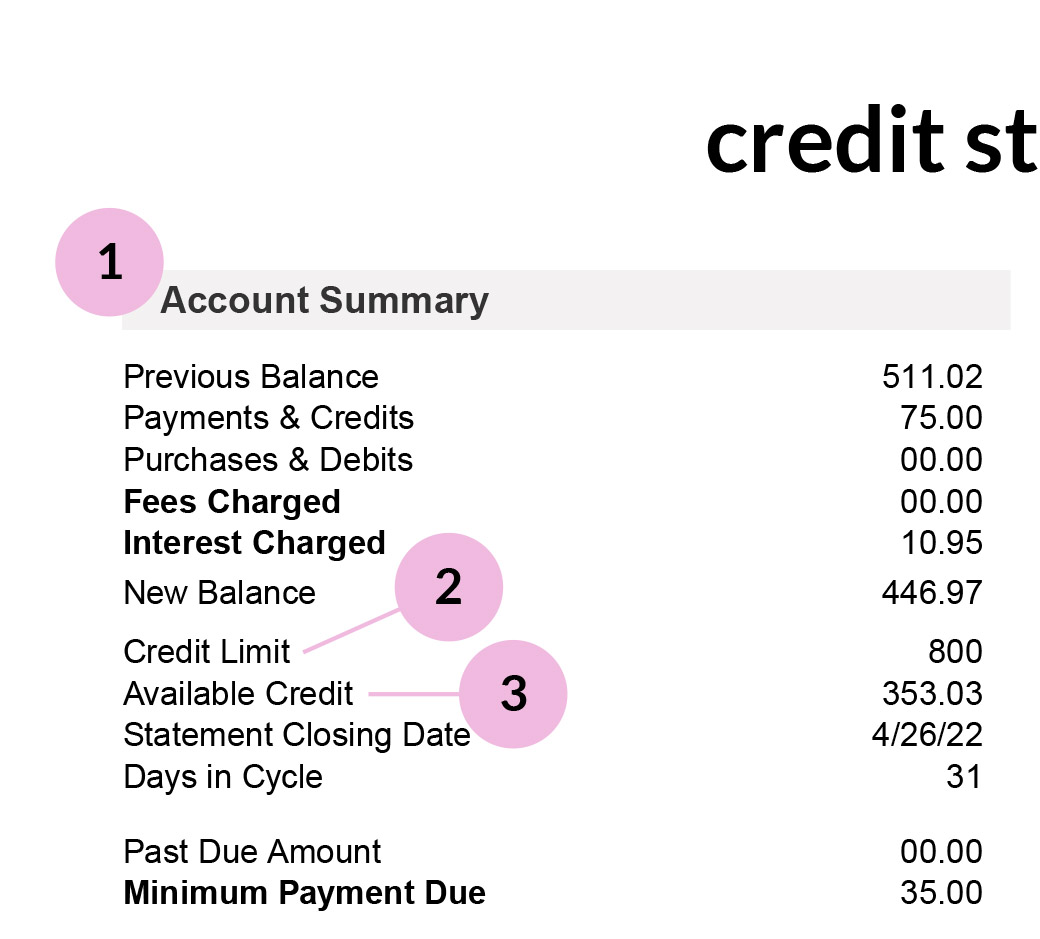

Account Summary

1. Your Account Activity Summary

Your newest balance, previous balance, payments, credits, new purchases and interest charges are here.

2. Credit Limit

The maximum amount you can charge to your account.

3. Available Credit

This is the amount available to you for purchases. This amount is your charges subtracted from your credit limit.

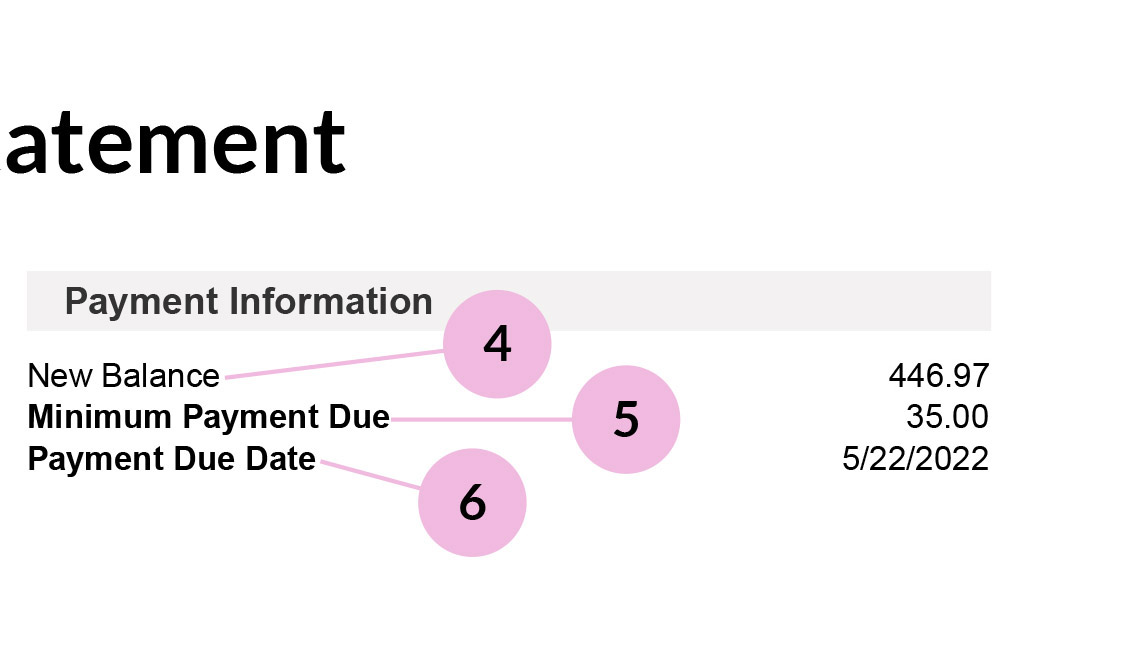

Payment Information

4. New Balance

The total amount you owe. This includes any unpaid balances from previous months, new purchases, late fees and interest charges.

5. Minimum Payment Due

The minimum amount you must pay each month. If you pay more than the minimum, you will pay off your balance more quickly with less interest charges.

6. Payment Due Date

The day your payment is due. If your payment is received after this date, a late fee may be charged.

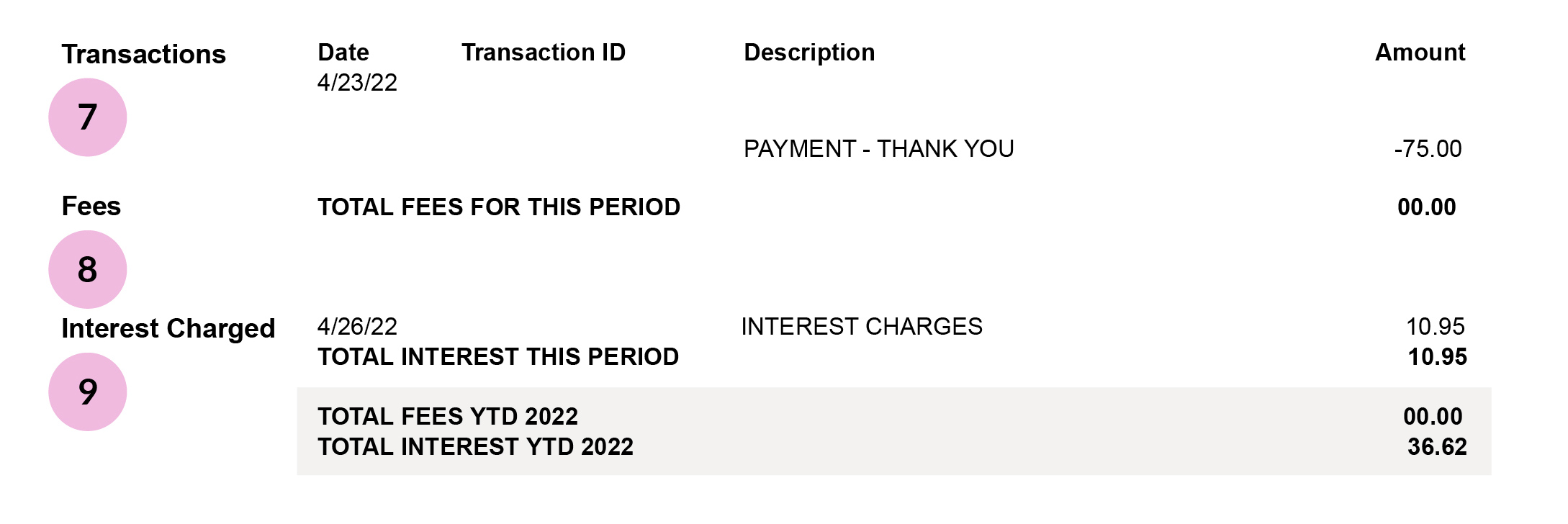

Transactions

7. Transactions

A list of your new purchases and payments made since your last statement.

8. Fees

This may list any fees and reasons you were charged for them during the billing period.

9. Interest Charged

See the exact amount of interest charged during this billing period. Interest charged year to date is also provided.