As New Year’s Day approaches, you’re probably thinking about the year ahead. You may have resolutions for your health, family or job, but have you thought about your credit? Is it ready for 2023?

To get the new year off to a strong start, we’ve put together 8 tips to help you get credit ready.

1 review your budget

If you’ve been keeping a budget, congratulations! The beginning of the year is a good time to review it and make adjustments if your income or expenses have changed.

Don’t have a budget? This is a great time to make one. It can help you manage your money and plan for the future. This article can get you started:

https://blog.fingerhut.com/a-budget-can-improve-your-relationship-with-your-money/

Oh, and here’s a link to a printable budget worksheet from the Consumer Financial Protection Bureau: https://files.consumerfinance.gov/f/documents/cfpb_well-being_monthly-budget.pdf

2 check your credit report

Knowing where your credit stands now can help you plan for the future, so it’s a good idea to check your credit report regularly.

Your credit report shows your credit history, including loans, credit accounts, payment history and inquiries. Review it to make sure your personal info is current, your financial info is correct and there are no signs of identity theft (like a credit account you didn’t open).

You are entitled to one free credit report per year from each of the three major credit reporting companies (Equifax, Experian and TransUnion). Go here to learn more: https://consumer.ftc.gov/articles/free-credit-reports

You can also get free weekly online credit reports through December 2023. Get more info here: https://consumer.ftc.gov/consumer-alerts/2021/03/free-weekly-credit-reports-during-covid-extended-through-december-2023

3 resolve to make on-time payments

Making on-time payments on all your bills is one of the best ways to build positive credit history.

Set a calendar reminder or keep a schedule of when payments are due. Better yet, set up automatic recurring payments if that’s an option.

4 keep an eye on your credit utilization rate

Your credit utilization rate (CUR) shows how much of your total available credit you’re using. Why is your CUR so important? It counts for up to 30% of your credit score.

You can calculate your credit utilization rate by dividing the total amount of credit you’re using by your total available credit. Keeping your CUR at 30% or lower shows lenders you’re managing credit responsibly.1

5 take steps to protect your identity

Identity theft can be a major roadblock on your credit journey, so take steps to prevent it.

Keep papers in a safe place and shred old documents.

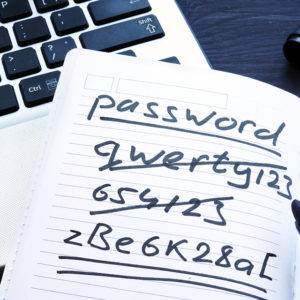

Use strong passwords and a password manager for electronic records.

Avoid giving your full Social Security number or other personal info to someone you don’t know.

Check your bank and credit statements for unusual charges or activity.

6 avoid credit-repair scams

Beware companies that claim they can repair your credit report or raise your credit score.

Your credit info stays on your credit report for a fixed amount of time and can’t be changed unless it’s incorrect.1 A company that says it can get info removed could be scamming you.

According to the Consumer Financial Protection Bureau, credit-repair companies must follow laws regulating their industry. You can find out more here: https://files.consumerfinance.gov/f/documents/092016_cfpb_ConsumerAdvisory.pdf

7 set or update your financial goals

Where would you like to be a year from now? Five years from now? Financial goals can help you get there, especially if some of your goals involve your credit.

Take time to think about your goals and write them down. We like the SMART goals method. SMART goals are Specific, Measurable, Achievable, Relevant and Time-Bound.

You can find out more about SMART goals here: https://blog.fingerhut.com/smart-financial-goals-can-help-turn-your-dreams-into-reality/

8 consider adding a credit account

You can build credit history by adding a credit account and using it wisely. Credit scoring models often consider the number and type of credit accounts you have (revolving credit and installment loans). A mix of credit could help your credit score.2

Before opening an account, make sure that the monthly payments will work with your budget.

Now you’re ready to start your 2023 credit journey. Remember, it takes patience and persistence to build or rebuild your credit history. Stick with it so you’ll have a reason to celebrate in 2024.