Have you noticed that suddenly there are a lot of Buy Now, Pay Later (BNPL) options out there? Doesn’t it seem like there’s a new one every week? They’ve started popping up everywhere, like in checkout when you’re shopping online. Some even have smartphone apps that let you use BNPL when you’re shopping IRL.

At first glance, they may seem like an easy and convenient way to shop. Say you want a new pair of shoes for the gym but can’t really afford them right now. Most traditional BNPL options let you get them today and split the total into four fixed-and-equal payments.

Does that mean you should use BNPL?

Well, they might be OK for a one-time purchase, but even for those there’s a smarter alternative – a WebBank/Fingerhut Fetti Credit Account.

Now, you’re probably thinking, does it really matter whether I use BNPL or a WebBank/Fingerhut Fetti Credit Account?

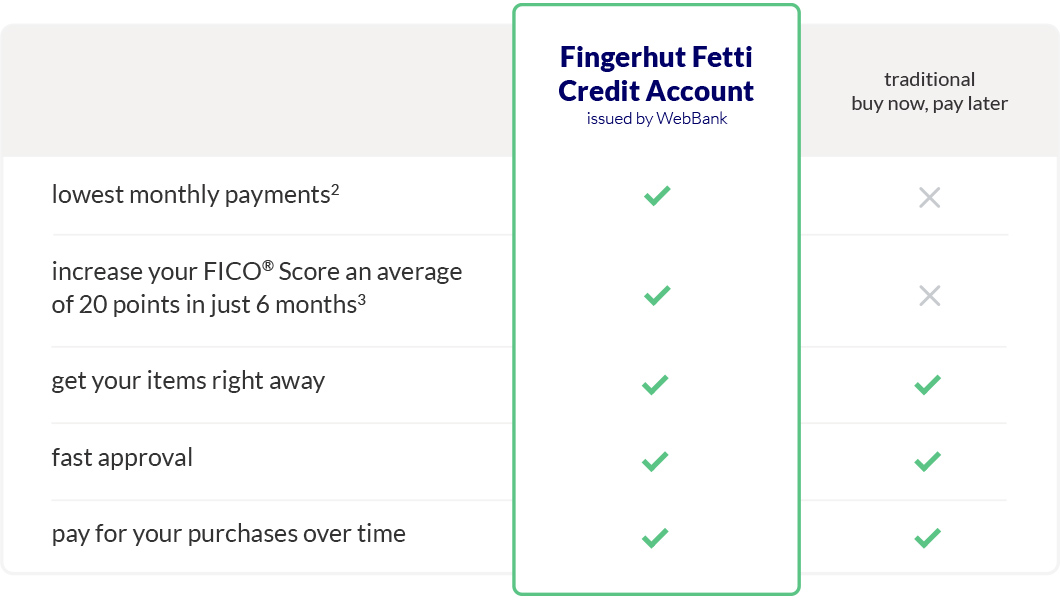

Yes, it does. Sure, they both are alike in a few ways, but it’s how they’re different that can have a big effect on your budget and your credit future.

You can see that both have a fast approval process and will let you know right away if you’re approved or not.

They also let you get your items right away. No waiting around, like you’re forced to do when you use layaway.

Finally, both let you pay for your items over time, which can make it easier on your budget. Unfortunately, payments on most traditional BNPL aren’t always easier. We’ll talk about that more in the next section.

difference #1

lowest monthly payments2

When you use a WebBank/Fingerhut Fetti Credit Account to make a purchase, your low monthly payments are calculated using your balance.

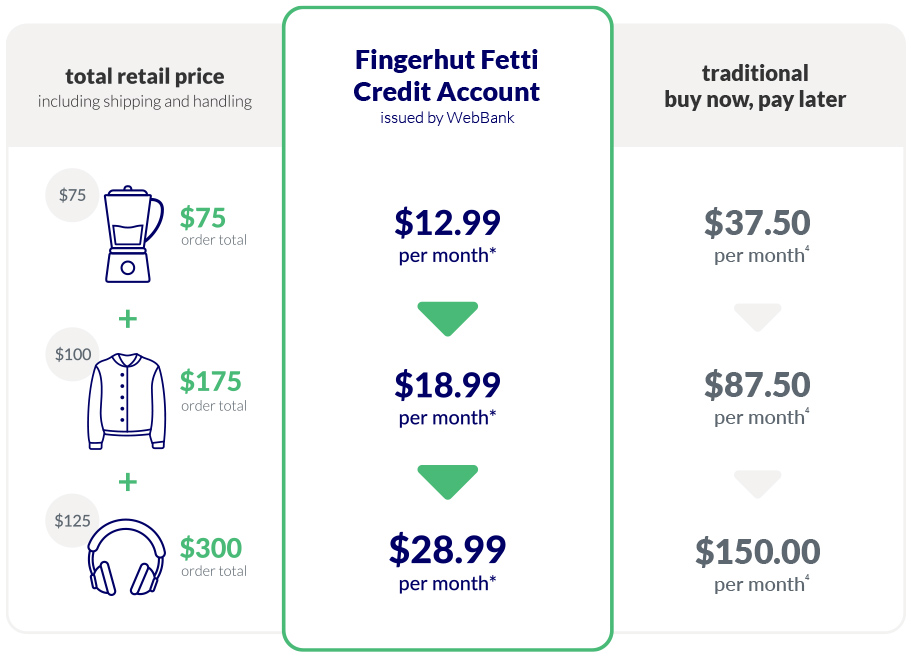

Like we mentioned earlier, with traditional BNPL your payments are split into 4 fixed–and–equal payments. Those may sound easy to handle at first, but what happens when you buy more than one item or make multiple purchases from different places?

Your fixed payments will start to stack up – higher and higher – with every item and every purchase.

The shorter payoff period could also put a credit crunch on your budget, especially if you buy higher-priced items.

Here’s a head-to-head comparison showing how you’ll get the lowest monthly payments2 with a WebBank/Fingerhut Fetti Credit Account. Plus, you can see that your payments won’t stack up as high as BNPL.

difference #2

increase your FICO® Score by an average of 20 points over a 6-month period3

Use a WebBank/Fingerhut Fetti Credit Account and make payments, and we’ll report them to all three credit bureaus: Equifax, Experian and TransUnion.

So, every time you make an on-time payment, it’ll improve your credit history. And because your payment history counts for up to 35% of your FICO® Score, every on-time payment may also increase your FICO® Score. By how much? We’re talking an average of 20 points over a 6-month period.3

Most BNPL can’t help your credit history or credit score.5 Why? Most don’t report your payment history to any of the credit bureaus, but some may report any late payments you have. Shocking, right?

difference #3

credit education and support

This may turn out to be your favorite. When you have a WebBank/Fingerhut Fetti Credit Account, you’ll get credit tips to support you while you’re on your credit journey. Plus, there are tons of helpful articles right here on this blog. Read them to learn more about everything from credit to budgeting to finances.

Last, but certainly not least, you’ll have the support of the entire Fingerhut family. And we are always rooting for you.

final thoughts

Both Fingerhut and BNPL offer a fast approval process and you can get your items right away, but with Fingerhut you’ll get the lowest monthly payments2 and have the potential to increase your FICO® Score3.

Disclaimers

* For complete information on your total of payments and time period to repay for a single item purchased at the advertised price per month, see full cost of ownership.

Advertised Price Per Month: The advertised price per month is the estimated monthly payment required to be made on your WebBank/Fingerhut Fetti Credit Account for a single item order, or if at any time your account has multiple items on it, then please see the payment chart for payment terms. The advertised price per month will not apply.

2 Based on purchases of $40 or more with a WebBank/Fingerhut Fetti Credit Account versus a typical 6-week, 4-payment BNPL option.

3 Based on the average FICO® Score increase of WebBank/Fingerhut Revolving Credit Account and WebBank/Fingerhut FreshStart Credit Account customers who opened their account and purchased between 9/2020 and 8/2021 and kept their account current for 6 months. Average increase is based on FICO 8 methodology.

4 Based on a typical 6-week, 4-payment BNPL option.

5 https://www.consumerfinance.gov/about-us/blog/should-you-buy-now-and-pay-later/

Fingerhut Credit Accounts are issued by WebBank.

FICO® is a registered trademark of Fair Isaac Corporation in the United States and other countries.